Applicability

In order to analyse the applicability of the Equalisation Levy, it is first necessary to understand the scope of the levy on ecommerce. As per Section 163(3), the levy shall apply to consideration received or receivable for e-commerce supply or services made or provided or facilitated on or after the 1st day of April, 2020. Further, the scope shall be restricted to only those consideration which are not taxable as royalty or Fee for technical services. Therefore, all incomes other than royalty / FTS are covered under the scope including the services which are as on date getting claimed as not taxable as not satisfying make available condition in treaties. The important point to be noted that as there is no clarity, all the business incomes are covered under scope of equalisation levy.

Who is covered?

Thenextquestion to be answered is on whom the equalisation levy apply. In this regard, it is to be noted that the term e-commerce operator is restricted to only non-resident entity and thus, EL is not applicable on resident. Another requirement is that the non-resident entity shall be either owning, operating or managing a platform or digital facility for online sale.

On what EL is charged?

EL is charged on e-commerce supply of goods or services. The term has been very widely defined under law to include even incidental activity of making payment online or only accepting the offer online without contract being entered online. Thus, considering the digital world we are in, this condition is immaterial as far as levy is concerned as it applies to virtually all transactions because one or the other activity must be happening online. This is specially when the term online has been defined as a facility or service or right or benefit or access that is obtained through the internet or any other form of digital or telecommunication network.

On what value EL will be charged?

Another question once we determine the applicability of EL comes out is the quantum on which EL is levied. Section 165A of the Finance Act 2016 provides that EL will be levied at the rate of 2% of the gross value of consideration received by e-commerce operator for from e-commerce supply or services made or provided or facilitated by it. The government has added an explanation to provide that consideration shall include consideration for goods/ services whether or not they are owned by the E-commerce operator however, it excludes the value of goods/ services provided by a entity resident in India or through a PE in India.

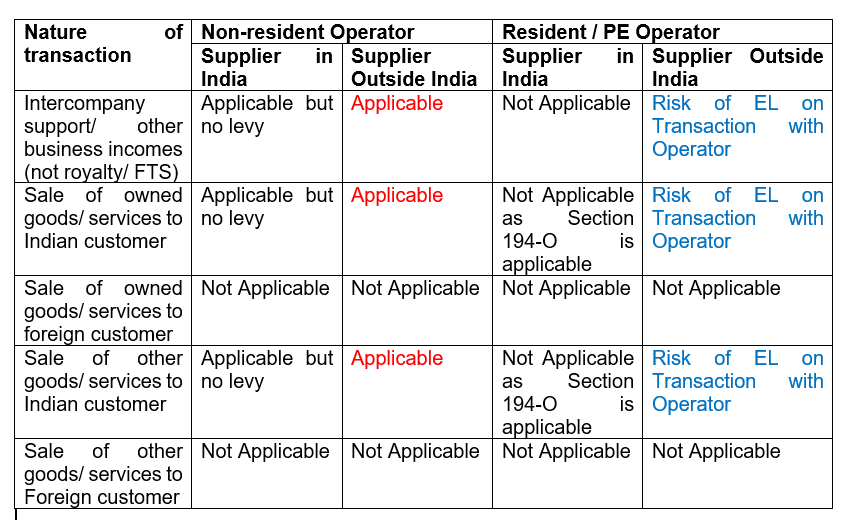

The below matrix outlines the applicability of EL in different cases:-

Ambiguity still exists

The definitions provided under law are very wide and covers some situations which are not intended to be covered by the government. A classic example of this is the normal trading transaction of goods. In most of the cases, the communication or payment for such trading transactions are done online and therefore, there is likely a risk that equalisation levy applies to all trade transactions between a resident and a non-resident particularly when the e-commerce supply is so widely defined to cover any online facility including emails/ internet banking etc. In this regard, it is imperative on government to come out with a clarificatory notification/ circular to remove any doubts on the applicability of the levy.

Ambiguity still exists

The definitions provided under law are very wide and covers some situations which are not intended to be covered by the government. A classic example of this is the normal trading transaction of goods. In most of the cases, the communication or payment for such trading transactions are done online and therefore, there is likely a risk that equalisation levy applies to all trade transactions between a resident and a non-resident particularly when the e-commerce supply is so widely defined to cover any online facility including emails/ internet banking etc. In this regard, it is imperative on government to come out with a clarificatory notification/ circular to remove any doubts on the applicability of the levy.

Another example of it includes provision of various support services by multinational companies to the Indian entity. In these cases as well, the services either rendered online or atleast the acceptance of the services are done through an email and therefore, these are likely to get covered under equalisation levy net if the transactions are not considered as royalty or Fee for Technical Services.