Non-Banking Financial Company – NBFC Registration

Non-banking financial company (NBFC) is a kind of financial institution which provides financial services to individuals as well as to business entities. Such financial services similar to that of the banks but it doesn’t necessitate banking license but such company owns NBFC License. NBFCs act as an alternative to the banks as they provide financial solutions to the unorganized part of the society.

Regulated Authority Of NBFC

The Reserve Bank of India (RBI) formulates rules & regulations for NBFCs therefore license from RBI is required for starting NBFC in India as per Section 45-IA of the RBI Act, 1934. The RBI is authorized to regulate NBFCs by ensuring that they are complying with the prescribed rules & regulations.

Principal Business Requirement For NBFC

The principal business of NBFCs is to provide financial services which involves lending, investments in shares, stocks, bonds, debentures, leasing, hire-purchase, P2P Market Place lending business, financial information service provider (NBFC-AA) insurance business or involved in the receiving of deposits under any scheme or arrangement.

Besides this, following below mentioned conditions must be fulfilled in order to continue NBFC License:

- Total Assets comprises more than 50% financial assets

- More than 50% of the gross income should be generated from financial assets

To regulate & supervise functions of NBFC, RBI has two departments which are as follows:

Restricted Activities

- Agricultural Activity

- Industrial Activity

- Sale / Purchase of Goods and Services

- Sale / Purchase of construction of immovable property

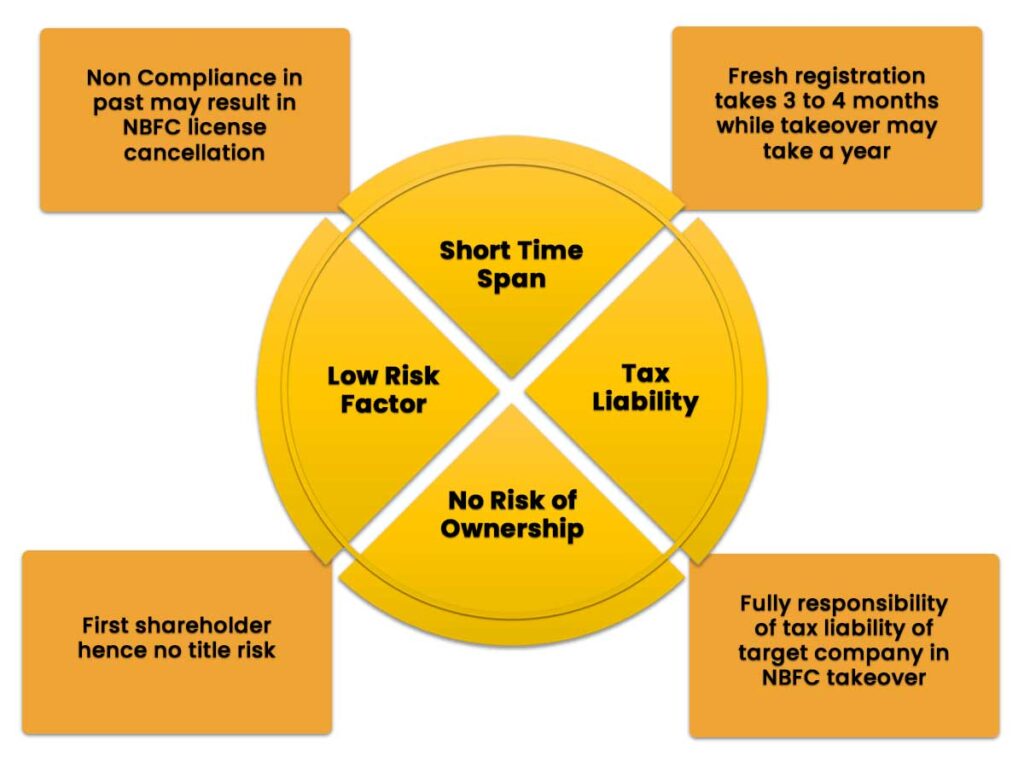

Another way of starting finance business is to takeover an existing NBFC however it is always advisable to go for fresh NBFC registration.

Now, You Must Be Wondering Why?

Types of NBFC

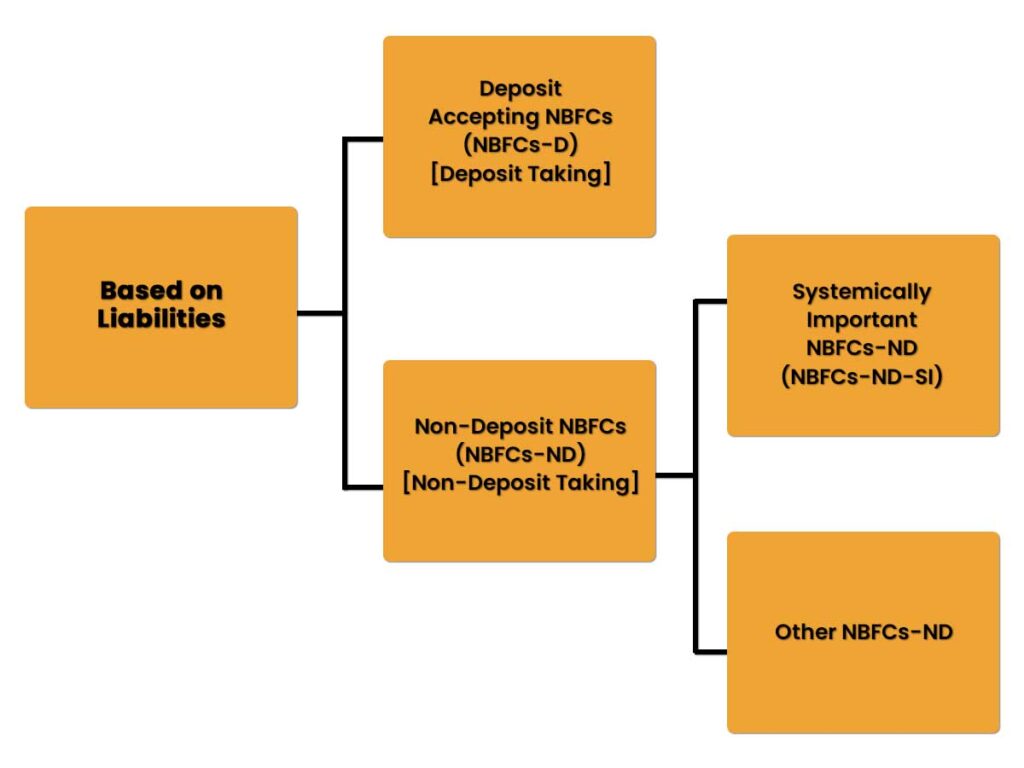

NBFCs are classified into two types:

On The Basis Of Liabilities

NBFC – ND whose asset size is Rs. 500 Crore and more as per the last audited balance sheet is considered as Systemically Important NBFC (NBFC-ND-SI).

Asset size of the group companies to be clubbed

NBFC-ND-SI has to follow the policies prescribed by RBI mandatorily and exempt from Credit Concentration Norms.

NBFC-ND-Non SI is exempt from observing Prudential Norms, 2015 (except Annual Certificate)

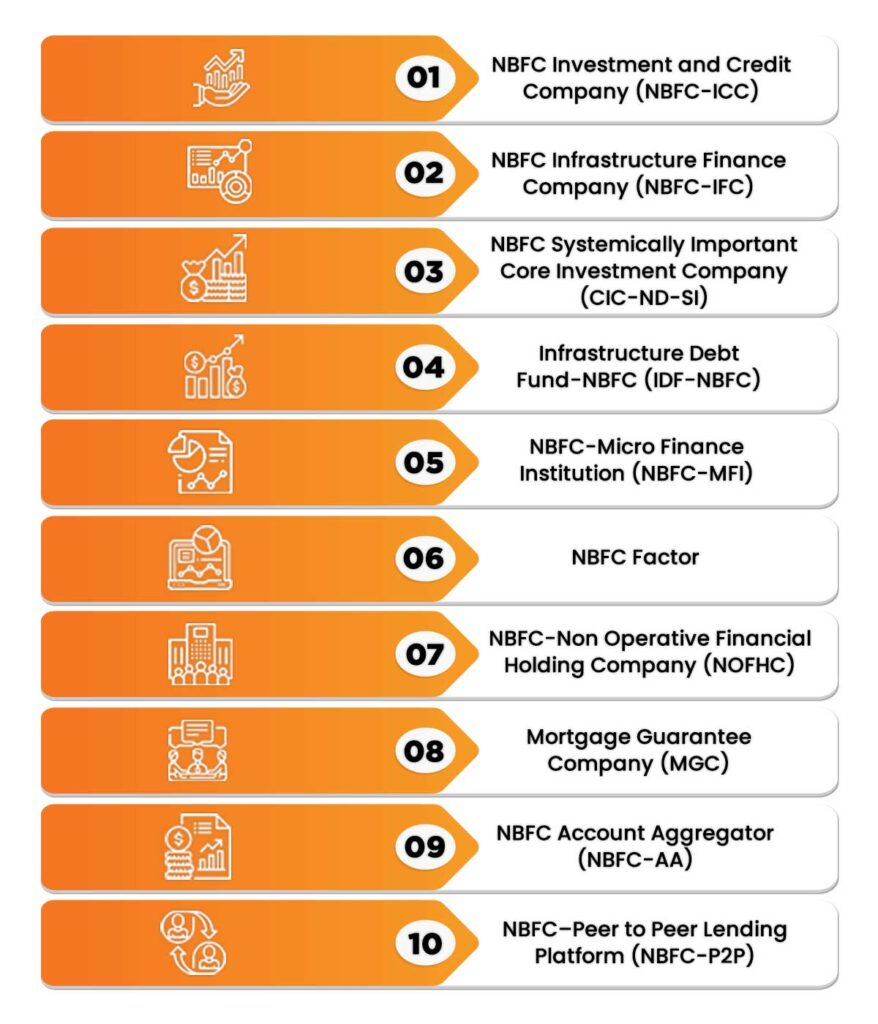

On The Basis Of Activities

- NBFC-Investment And Credit Company (NBFC-ICC)

It is a kind of NBFC which deals with the lending and investment activities. Previously there were three categories which were later merged into one to provide greater operational flexibility.

[Asset Finance Company + Loan Company + Investment Company = Investment and Credit Company]

- NBFC-Infrastructure Finance Company (NBFC-IFC)

This type of financial institutions is primarily engaged in providing infrastructure loans.

- NBFC-Systemically Important Core Investment Company (CIC-ND-SI)

Its activities are mainly involved in investment in equity shares, preference shares, debt or loans of group companies.

- Infrastructure Debt Fund-NBFC (IDF-NBFC)

Activities of NBFC-IDF are mainly concerned with facilitation of flow of long-term debt into infrastructure projects.

- NBFC-Micro Finance Institution (NBFC-MFI)

NBFC-MFI is mainly formed to provide credit to economically disadvantaged groups.

- NBFC-Factor

Their main activity is concerned with acquisition of receivables of an assignor or extending loans against the security interest of the receivables at a discount.

- NBFC-Non-Operative Financial Holding Company (NOFHC)

Facilitation of promoters/ promoter groups in setting up new banks

- Mortgage Guarantee Company (MGC)

Undertaking of mortgage guarantee business

- NBFC-Account Aggregator (NBFC-AA)

Collecting and providing information about a customer’s financial assets in a consolidated, organized and retrievable manner to the customer or others as specified by the customer.

- NBFC–Peer To Peer Lending Platform (NBFC-P2P)

It provides an online platform to bring lenders and borrowers together to help mobilize funds

How NBFCs are different from Banks?

We can differentiate NBFCs from banks on the basis of following points:

- Meaning

- NBFCs provide banking services to people without holding Bank license.

- Bank is a government authorized financial intermediary which aims at providing banking services to the public.

- Regulated Authority

- In case of NBFCs – Companies Act 2013 & RBI Act, 1934

- In case of Banks – Banking Regulation Act 1949

- Demand Deposit

- NBFCs cannot accept demand deposits.

- Banks can accept demand deposits.

- Foreign Investment

- In case of NBFCs, foreign investment is 100% allowed.

- Foreign investment is allowed up to 74% for private sector banks.

- Payment And Settlement System

- NBFCs – not a part of system

- Banks – Integral part of the system

- Maintenance Of Reserve Ratios

- Not required in case of NBFCs.

- Banks have to maintain reserve ratios.

- Deposit Insurance Facility

- NBFCs – Not available

- Banks – Available

- Credit Creation

- NBFCs do not create credit.

- Banks create credit.

- Transaction Services

- NBFCs cannot provide transactions services.

- Banks provide transaction services.

Importance & Functions of NBFCs in India

NBFC registration is very important for a person who wants to carry finance business in India. NBFCs cater wide range of customers and provide loans to the deprived sections of the society including both urban & rural areas in this way they contribute towards the growth of the country. Moreover, the interest rate at which a NBFC advances loan can be decided by itself keeping RBI guidelines in mind.

Functions Of NBFC Are As Follows:

- Providing customized loan solutions

- Digital platform to provide loans using advanced technology

- Faster processing of loan

- Employment generation

- Wealth creation

- Infrastructure development

- Financial assistance to financially weaker section of the society thus economic development

Advantages of NBFC registration

Opportunities after NBFC registration

The business environment in India is favourable for NBFC for its exponential growth. The Reserve bank of India highly regulates financing business in India. A Registered NBFC helps in gaining the confidence of borrowers, gives the security of capital invested in the business.

Therefore, NBFC registration offers many benefits.

- Lowest Business and legal risk

- High confidence of a customer after Grant of NBFC license

- Easy to Raise Investments in NBFC

- Access of CIBIL and Other Credit Bureaus data

- Open Interest Rate

- Free to charge Processing Fees–

- Protection by law for recovery of loan

- Easy Bank Finance

- Up to 100%, allowed by FDI

- Leverage of technology and Low Operation Cost

- A decline in Bad Loans due to credit reporting to Bureaus

Pre Requisites for NBFC Registration

For NBFC registration, below mentioned conditions must be fulfilled as per Section 45-IA of the RBI Act, 1934:

- Company Registration

An applicant must be a company registered under companies Act 1956 or Companies Act 2013.

- Director’s Experience

1/3rd Directors of the applicant company must possess experience in finance field in order to apply for NBFC license.

- Five Year Business Plan

An applicant company needs to draft detailed business plan for the next five years.

- Minimum NOF (Net Owned Fund) Requirement

The applicant company must possess minimum NOF of Rs. 2 Cr. Tax must be paid on it.

- Qualify Capital Test

The RBI undertakes quality of capital test to check that invested capitalis free non-compliance with the prescribed laws.

- Credit History

The credit score of the company, directors & its shareholders must be fineand they must have not defaulted loan re-payment deliberately to banks or to NBFCs.

- Quality Of Capital

An applicant company must have complied with the mandatory compliances.

- FEMA Compliances

In case of involvement of foreign investment, an applicant company must have complied with the FEMA Act. 100% FDI is allowed from FATF member countries.

Documents Required for NBFC Registration

- Certified copy of COI (Certificate of Incorporation) / MOA / AOA

- Net Worth Certificate of Directors, Shareholders & Company

- Educational qualification documents of the proposed directors

- Highest Experience certificates

- Directors & Shareholders business profile

- Credit report of directors & shareholders

- KYC details, PAN of the company, GST number, address proof of the company

- Bank account details of the company [Rs. 2 Cr must have deposited as NOF]

- Audited balance sheet of last 3 years or from the date of incorporation

- Related Party Disclosures

- Income tax Returns

- Banker’s Report confirming no lien on fixed deposit

- Format of board resolution regarding NBFC registration

- Underwriting model – Detailed action plan of next 5 years including Fair Practice Code and risk assessment policy

- Business Structure & Loan Structure

- IT Policy

What is the NBFC Registration Procedure?

Follow The Below Mentioned Steps To Establish Your NBFC:

- Hire experienced NBFC registration consultant who is having at least 10 year’s experience and having a team of experienced professionals like CA, CS, lawyers and senior bankers.

- The proposed name of the company must include Finance, FinServ, Final, Investment, Capital, Fintech, and Leasing etc.

- Register a Private Limited or Public company

- Plan your Registered office, City and Area of Operations

- Obtain certificate of Incorporation from Registrar of Companies

- Deposit Net Owned Funds in bank account opened for company

- Documentation for obtaining NBFC license

- Drafting of Business Plan for the next 5 years consisting:

- Executive Summary

- Product Plan

- Lending Model

- Risk Model

- Peer Analysis

- SWOT Analysis

- Financial Projections

- Apply for registration with RBI under RBI Act, 1934.

- Applicant Company has to file an online application with the RBI on its official website.

- After this, an applicant will get a reference number (CARN) to facilitate inquiry in the future.

- After this, it is required to submit the duplicate hard copies to the concerned regional office of RBI.

- The regional office shall check the accuracy of all submitted documents.

- The regional office will send the application for NBFC registration to the central office.

- The central office of RBI grants NBFC registration only when applicant company fulfills prescribed requirements under section 45-IA.

- NBFC must commence its business within 6 months from the date of Certificate of Registration

RBI Conditions for Granting NBFC License

- After filing application for NBFC registration, RBI will scrutinize the file and grant license only after satisfying the below mentioned conditions:

- Ability of NBFC to repay its dues to investors and Business Plan of the company must fulfill the larger interest of the society

- NBFC activities shall not be detrimental to the interest of the Public at Large

- Capability to Infuse Sufficient capital

- Earning capability of the Proposed Business

- Activities shall be carried out in such a manner that it shall be in the public interest

- Board shall act in the interest of public or depositors

- Granting license will contribute to the economic growth of the country

- Proposed NBFC shall comply with the RBI regulations