Prepaid Wallet License

Prepaid Payment Instruments, otherwise called PPIs, works as a payment instruments which encourages the products and ventures transactions directed by the shopper, including financial administrations, settlement offices and so forth against the worth put away on such instruments. The Prepaid Wallet License have risen as a brilliant and helpful strategy for starting cashless exchange in the ongoing occasions where the nation has encountered a ton of money crunch. It is a successful mode of payment that supports transparency, versatility and responsibility.

Generally PPIs Are Also Called As E-Wallets.

- Closed Prepaid Payment Instruments Or Closed Wallets: These might be given by any element which may incorporate people, sole-proprietorship, association firms and so forth for the acquisition of goods and services from that element only. As these instruments can’t be utilized for payments and settlement for outside exchanges, the issue and activity of such don’t require endorsement by the Reserve Bank of India.

- Semi-Closed Prepaid Payment Instruments Or Semi-Closed Wallets: PPIs under this classification can be utilized for acquisition of merchandise and ventures from a gathering of dealers joined for this lone reason. Money withdrawal and reclamation isn’t permitted by the holder of such instruments. All substances including people, NBFCs are allowed to carry on the matter of semi-closed wallets subsequent to getting permit from Reserve Bank of India.

- Open Wallets: This is a kind of wallet which can be utilized to buy products and services and furthermore license money withdrawal at ATM’s. These wallets can be utilized for acquisition of products including money related administrations, for example, fund transfer at trader areas, additionally money withdrawal at automated business journalists. In this manner these are wallets used to purchase merchandise and enterprises, including fund transfer at merchant location, likewise license money withdrawals at ATM’S. All Visa and master cards fall into this class. Only banks have the authority to issue and use open-wallets.

- Cross Border Transactions: The people approved under FEMA to give the Foreign Exchange designated Prepaid Payment Instruments don’t draw in the arrangements of PPI rules according to the RBI notice. As far as possible is set for INR 5000/ – for such cross outskirt exchanges.

Minimum Capital Requirement

Banks: there is no different capital prerequisite determined for Licensed/Scheduled Banks or NBFCs enrolled with Reserve Bank of India. They will be approved to give the PPI in the wake of acquiring endorsement from RBI.

For different elements: A minimum positive total assets of 25 crores according to the last inspected Balance Sheet will be kept up by all substances looking for endorsement.

Other Conditions relating to Capital Requirement

The Net Worth Will Comprise Of The Accompanying Things:

- Settled up Equity capital;

- Inclination shares;

- Free Reserves;

- Offer premium record; and

- Capital reserves representing surplus

- If there should arise an occurrence of recently consolidated organizations, a certificate from their Chartered Accountant in regards to the present total assets alongside interim balance sheet will be submitted. In addition, the documents according to capital imbuement and other funds gained to begin the business will likewise be submitted.

- If there should arise an occurrence of Banks and NBFCs, the endorsement is given by the Supervisory Department of the RBI.

- The current PPI backers who got the permit from RBI under past capital necessities will be at risk to expand their total assets as per the current measures by September 30, 2020, bombing which their permit will be dropped.

- Company incorporated under Companies Act, 1956 or Companies Act, 2013 will be approved to apply for the permit from RBI.

- The article provision of the MOA of the candidate organization will determine the proposed movement of working as a PPI backer.

Authorization Process for Non-Bank entities

- An application will be made by each non-bank element looking for endorsement for permit in Form A as mentioned under Regulation 3(2) of the Payment and Settlement System Regulations, 2008.

- Most importantly, RBI makes a decision about the by all appearances qualification of the candidate in fundamental screening.

- Further, the ‘fit and legitimate’ status of the candidate and the administration is evaluated after receiving feedback from controllers, government specialists and so on.

- In the event that the candidate substance doesn’t meets the qualification rules, the application will come back with no refund of the fees.

- Aside from the qualification standards, the application will likewise be evaluated on the grounds, for example, client assistance and proficiency, specialized and other related prerequisites.

- On the satisfaction of each condition, the in-head endorsement is allowed by the Reserve Bank of India, whose legitimacy is of six months. Within six months of the in-principal approval, the substance is required to present an agreeable System Audit Report, bombing which the on a fundamental level endorsement will lapse naturally.

- The elements which have been conceded last endorsement will initiate their activities inside a half year of the endorsement bombing which the approval will slip by naturally. A one-time augmentation of a half year can be acquired by making a solicitation in writing in advance to the RBI with legitimate reasons. The RBI maintains whatever authority is needed to acknowledge or reject such application for augmentation.

- The Certificate of Authorization will be legitimate for a long time from the date of its issue.

- For recharging of permit, the application to the RBI will be submitted three months before the expiry of the permit, bombing which RBI claims all authority to acknowledge or reject such application for reestablishment.

Documents Required for Obtaining Prepaid Wallet License

- Name of the applicant

- Constitution of the applicant

- Address proof of registered office

- Certificate of Incorporation

- Main business of the company

- Management Information

- Statutory auditor of Company

- Audited balance sheet

- Name and address of bankers of Company

- Any other documents as may be required

Prior Written Permission by Non-Bank Entities

All non-bank substances being allowed the Certificate of Authorization to issue PPIs in the nation will be required to take written approval from the Reserve Bank in the accompanying cases:

- Any takeover or securing of control of non-bank substance, which could conceivably bring about difference in the board;

- Any adjustment in the administration of non-bank element, which would bring about change in more than 30 percent of the chiefs, barring autonomous executives. Earlier endorsement will not be required for those chiefs who get reappointed on retirement by turn.

Deployment of money collected on Prepaid Wallet License

The measure of assets gathered against the issuance of e-wallets at a state of time could be huge. Additionally, the income from assets may likewise be quick. In the event that the settlement of assets is sure and in an auspicious way, the certainty of people in general and merchants, on the e-wallet framework will increment quickly. To ensure the auspicious settlement, the guarantors will contribute the assets gathered distinctly as from the issuance of e-wallets as follow:

The banks will keep the remarkable equalization as a piece of ‘net demand and time liabilities’ for keeping up the reserves in the Balance sheet which will be determined based on the parities showing up in the books of the bank as on the date of answering to the RBI.

Some other substance or people giving e-wallets will keep saved the extraordinary parity in an escrow account with any booked bank by RBI subject as per the general.

Inclination Of Following Conditions:

- The record will be kept up with just one bank at once;

- If the previously mentioned account is being moved starting with one bank then onto the next, it will be remembered that the procedure is finished in a period bound way and without influencing the payment cycles;

- The parity lying in the record will consistently be equivalent to or more noteworthy than the benefit of exceptional PPIs and payments because of merchants;

Validity of Prepaid Wallet License

All PPIs gave by the PPI guarantors will have a base legitimacy of one year from the date of its issuance to the PPI holder. The PPI issuers will imply the clients about the expiry of their PPIs in an auspicious way by SMS/email/post or by some other methods in the language favoured by the holder demonstrated at the hour of issuance of the PPI. Regardless of whether the PPI lapses, an effortlessness time of in any event 60 days will be given by the PPI backer to the client.

Peer to Peer Lending License

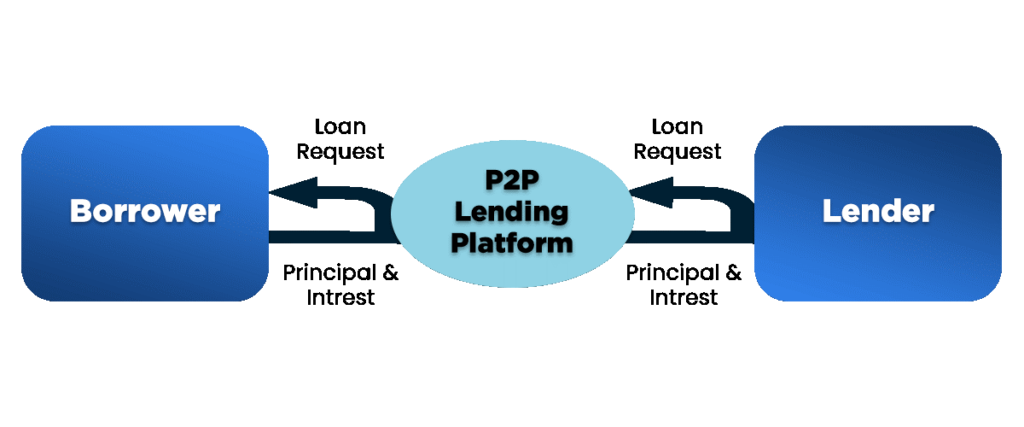

Peer to Peer (P2P) is essentially an online platform which works with the motive of raising loans which are to be repaid with intrigue. The borrower may either be an individual or a lawful entity. The online platform may set the financing cost to be charged on the loans or it might be chosen commonly between the parties. Peer to Peer lending has become a primary and comfortable choice of most of the start-ups and entrepreneurs during the initial days of their business when they are looking for venture funding. On this stage, business people can without much of a stretch obtain money from people.

Peer to Peer Lending is a strategy for obligation financing under which people can lend or borrow money without the contribution of any monetary organization as an intermediary. Peer to Peer lending companies is directed by the Reserve Bank of India. They work online thus making P2P lending a cost-effective strategy. P2P lending platform is a smart way of lending or borrowing money. It has proven profitable for both the parties in such a way that lenders can earn profit by lending their money at a higher rate of interest while borrowers enjoy the benefit of lower rate of interest.

P2P lending stages are innovation driven organizations which are enlisted under the Companies Act. They go about as an aggregator among lenders and borrowers. On P2P lending stage, lenders and borrowers register themselves on the site. From that point P2P lending platform completes due diligence and affirm the applications for support in loaning/obtaining action.

For doing a P2P lending business, one needs to get license from the Reserve Bank of India. For getting a P2P lending license, a legitimate application is filed with the authority alongside the essential documents by the experts.

Characteristics of Peer to Peer Lending Platform

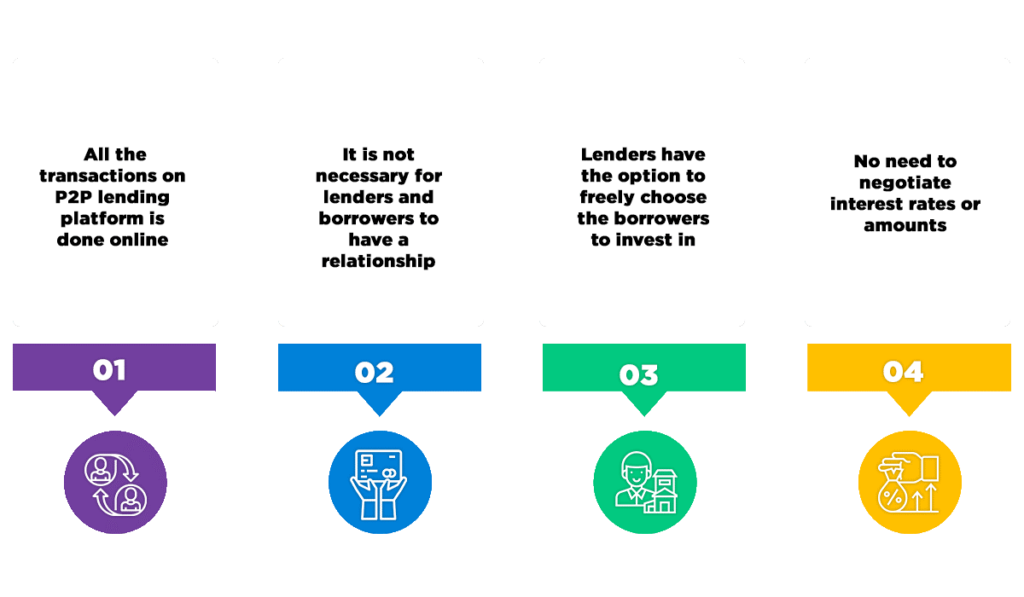

P2P lending model is making a huge impact on the activities of global financial market in fact many finance related industries are reshaping themselves from past few years by introducing new modules and lending services.

Custom designed P2P lending platform is the best option in contrast with old-style exercise of getting cash from banks as banks set aside long effort to endorse loans. Rather than moving toward banks and applying for credits, P2P lending stages can be utilized, where we just need to give essential data from the comfort of our home/office and within hours our advance will be prepared and approved.

- All the transactions on P2P lending platform is done online

- It is not necessary for lenders and borrowers to have a relationship

- Lenders have the option to freely choose the borrowers to invest in

- No need to negotiate interest rates or amounts

Benefits of Peer 2 Peer Lending

For Borrowers

- Low Interest RatesThe borrowers can profit the advantages of low loan costs when contrasted with banks and credit cards. At times decrease of about 35% has been seen.

- Fast Processing Of ApplicationSince P2P lending is done on the digital platform which makes the whole process of transaction fast and simple.

- Fixed Rate Of InterestP2P lending platform supports fixed rate of inters even on encountering the cases of late payment. Hence, many borrowers find this platform attractive and beneficial option to go with.

- Lower FeesP2P lending platform charge lower amount of fees.

For Lenders

- Higher ReturnsBy and large, the profits offered to the investors are higher, contingent on the kind of risk you attempt.

- Direct Communication With BuyerThe stage gives the lenders an alternative to legitimately speak with borrowers and concludes their arrangement with the borrowers.

- DiversificationInvestors are flooded with variety of options to invest their capital into.

Peer To Peer Lending Has Some Cons As Well And These Are As Follows:

For Borrowers

- Amount of loan is quite low in comparison to banks

- Often you experience more borrowers and less lenders

- Less Security

For Lenders

- Regardless of whether the credit rating assessment done by the stage is dependable or not, is a worry. In this way the hazard related isn’t sure.

- With the P2P business still in its incipient stage, it would be too soon to arrive at a complete resolution.

- Returns are lower in contrast with traded on an open market list finance

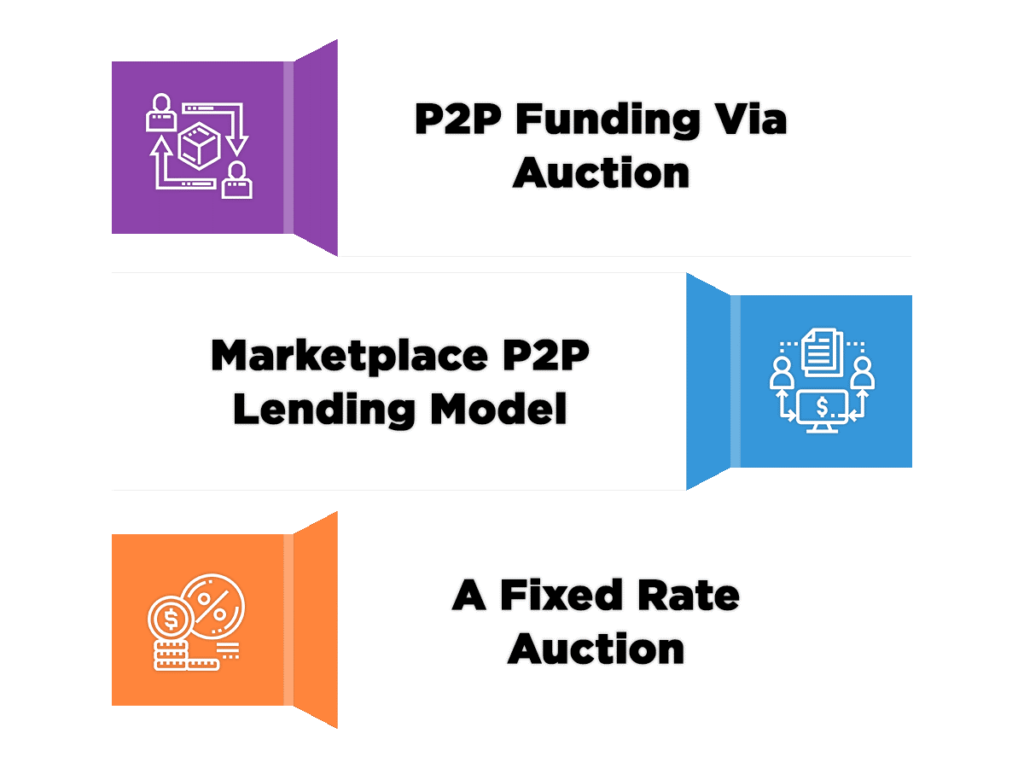

Funding Process under Peer to Peer Lending

- P2P Funding Via Auction: The lender at the p2p commercial center will rival each other to finance the borrower credit necessity at most minimal loan fees. The borrower loan will be subsidized by the minimum 7-20 lenders depending the loan sum and each piece of the advance may have an alternate pace of premium.

- Marketplace P2P Lending Model: In this model either P2P lending platform without anyone else or the money partners or a bank related with the stage will finish and guarantee the credit prerequisite of the Borrower. When this procedure is finished and the p2p loaning stage well offers the loan ID to intrigued moneylenders.

- A Fixed Rate Auction: For this situation, intrigue sum is fixed; just the advance sum must be financed by the loan specialists. This model is precise than commercial center strategy.

Eligibility Criteria for Obtaining Peer to Peer Lending License

- Company must be registered in India

- It is essential for applicant to have technological, entrepreneurial and managerial resources

- So as to complete P2P lending platform, a candidate must have satisfactory capital structure;

- Proposed Directors must satisfy the fit and legitimate models

- There must be a legitimate arrangement for proficient Information Technology System

- A feasible Business Plan

- Thought process to serve in public interest

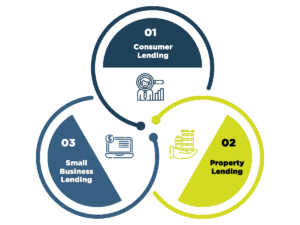

Types of Peer to Peer Lending Model

- Consumer Lending: Loans for cars/weddings/holidays/home repairs/repayment of credit card dues are easily available.

- Property Lending: This is made sure about P2P loaning against the first charge of the business or private property. The credit is obtained for individual home loans, Buy-to-lets, Residential restoration, and creating commercial loans. Though, this model does not have a strong fan base in India.

- Small Business Lending: Small businesses asked for SME loans because of the following purposes:

- Working Capital

- Business Expansion

- Asset Finance

Procedure of Obtaining Peer to Peer Lending License

Any business unit whether Private Firm or Public Firm is eligible to commence the business of P2P lending, to begin they need to apply to RBI for the P2P license. For this, they need to fulfil the following:

- Organization ought to be registered in India as Private Limited Company or Public Limited Company with the principal motive of financing;

- Least net possessed assets of INR 2 crores.

- WebSite/Mobile App Work Flow

- The online application is accessible on RBI’s site (COSMOS).

- Accommodation of printed copy of the application alongside joined documents will be submitted to RBI Office.

- The permit will be allowed simply after watchful review of the application and documents connected with it.

How does Peer to Peer Lending Platform Works?

On peer-to-peer lending platform, advances are taken by the borrowers from the individual financial investors (lender) who are eager to loan their cash to the borrowers on a concurred rate of interest.

On P2P lending platform, the profiles of the borrowers are shown, from where lenders can uninhibitedly pick the borrowers’ profile and indulge in the process of lending money. It isn’t important to have any connection among moneylender and purchaser.

It isn’t fundamental that proposed borrower get full loan amount, he may get certain measure of what he requested from a financial specialist (investor). For the rest of the amount, the credit might be given by at least one investor on the P2P lending stage.