Legal Entity Identifier (LEI) number

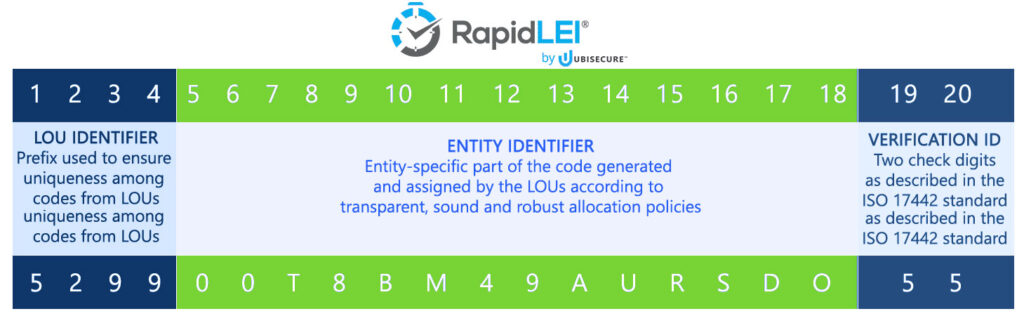

A Legal Entity Identity (LEI) number is a unique 20-character alphanumeric string (i.e. 529900T8BM49AURSDO55) used to distinctly represent a Legal Entity (company, organization, firm, government body, trust, fund, etc) on a worldwide basis. Once issued the LEI number can be used to represent the entity in financial transactions or organization identity assurance use cases. LEIs are required by all parties participating in regulated transactions and provide a publicly available verifiable source of ‘who is who’ (organization identity) and ‘who owns whom’ (organization group structures).

The LEI number is based on the ISO 17442 standard and assigned only to a single Legal Entity on a global basis. The system is maintained and operated by the Global LEI Foundation (GLEIF) and the ability to issue LEIs is only awarded to a limited number of organizations (like RapidLEI) passing a stringent accreditation process who then become LEI Issuers (formally known as LOUs – Legal Operating Units).

What type of Legal Entity may register an LEI number?

An LEI number may be requested by any of the following:-

- Registered Companies* and Registered Subsidiaries*

- Non Profits

- Sole Proprietors (Having a distinct identity within a business register)

- International Branch offices (The Head Office must already have an LEI)**

- Funds and Trusts

*As a general rule, a Business Registry will usually bestow a status of “Good Standing” to a business which maintains accurate information within the registry and completes any annual filing requirements. A Legal Entity does NOT have to be in Good Standing to be issued with an LEI, but MUST be ACTIVE. i.e. Legal Entities which have been struck off, merged, withdrawn or de-registered will be unable to receive or renew their LEI number.

**A branch office within an alternative jurisdiction/state, but still within the same country as the head office is not eligible as only one LEI per country can currently be issued.

As per RBI Circular No. RBI/2018-19/83 dated 29.11.2018; all participants, other than individuals, undertaking transactions in the markets regulated by RBI viz., Government securities markets, money markets (markets for any instrument with a maturity of one year or less) and non-derivative forex markets (transactions that settle on or before the spot date) shall obtain Legal Entity Identifier (LEI) codes by the due date indicated in the schedule given below:

Schedule for Implementation of LEI in the Money market, G-sec market and Forex market:

| Phase | Net Worth of Entities | Proposed deadline |

| Phase I | above Rs.10000 million | April 30, 2019 |

| Phase II | between Rs.2000 million and Rs 10000 million | August 31, 2019 |

| Phase III | up to Rs.2000 million | March 31, 2020 |

Note: Please refer extension Notification issued by RBI Vide no. RBI/2018-19/177 dated 26.04.2019

- Is it mandatory to obtain the LEI code? If so, then why?

Yes, It is mandatory for all legal entities to obtain LEI Code which

- How to obtain the same?

LEI code may be obtained from Legal Entity Identifier India Ltd. (LEIL) (https://www.ccilindia-lei.co.in)

a) Certificate of Incorporation/Registration Certificate

b) PAN Card proof

c) Undertaking –cum-Indemnity as per the format specified by LEIL

d) Audited Financial Statements

e) Board Resolution as per the format specified by LEIL OR A certified true copy of the general board resolution or general power of attorney will be accepted if the legal entity commits to submit a fresh board resolution in the format as prescribed by LEIL when the next Board Meeting is held subsequently.

f) Power of Attorney as per the format specified by LEIL in case of any further delegation by officials mentioned in Board Resolution.

g) Audited financials of Holding and Ultimate Parent or Auditor’s Certificate as per the format specified by LEIL in case of holding company and ultimate parent.

Validity of the code

LEI code is valid for one Year from the date of issue of code.

Consequences of not obtaining LEI code

Entities without an LEI code would not be eligible to participate in the OTC derivative markets, Government securities markets, money markets and non-derivative forex markets if the code will not be obtain till the due date specified in schedule mentioned above.